Driving Impact Through

Diversified Ventures

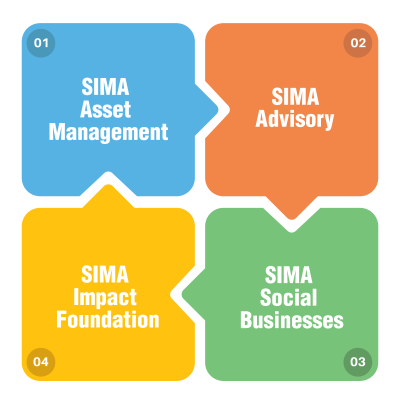

SIMA is a unique impact asset manager that also started operating businesses and has a dedicated foundation as well. We believe in driving impact through various avenues, and our subsidiaries play a pivotal role in achieving our mission. Each venture is purposefully crafted to address specific challenges and opportunities within the impact investing landscape. From renewable energy to inclusive finance, education to affordable housing, SIMA group operates at the forefront of their respective sectors, working diligently to create lasting social and environmental impact. Join us as we delve into the world of SIMA group, where innovation, expertise, and purpose converge to shape a better future for all.

SowGood Investment

Grow Wealth. Seed Change.

Sow Good Investment is a first of a kind internet-based crowdfunding platform in the US that seeks to bring impact investing in developing countries at the retail level where individuals in the United States can invest a couple of hundred dollars in well-protected assets and get a good financial return. By offering a carefully curated portfolio of socially and environmentally conscious investments, we empower retail individuals to align their financial goals with their values. Together, we can sow the seeds of a greener future while reaping financial rewards. Join us in cultivating a better world through sustainable financial growth with Sow Good Investment.

Sow Good Investment is being currently registered with the Securities and Exchange Commission of the United States (SEC).

SIMA Impact Foundation

Pushing the Frontiers of Impact Investing Where Blended Resources Are Essential

Not all impact investing possibilities are fully commercially viable and may require innovative thinking and subsidy to instigate innovative opportunities that have a deep social impact. The SIMA Impact Foundation is a 501(c)(3) public US charity and the philanthropic arm of SIMA Funds LLC. This is a first of a kind effort in the US market and has tremendous potential to innovate and drive change. As our first effort, we have been supporting underprivileged students in business schools in developing countries thereby not only providing full financial support but also the practical internship and training experience necessary to develop impact investing leaders from the bottom of the pyramid markets.

Asaan Ghar Finance

Fintech Affordable Mortgage Company Disrupting The Status Quo Through Technology

SIMA believes that the next big revolution in impact investing after microfinance is the ability to provide affordable mortgages. Asaan Ghar Finance Limited (AGFL)’s goal is to disrupt the status quo and empower the lower-middle and middle class to fulfill their dreams of owning a home, accumulate wealth, and elevate their standard of living. As a registered and licensed non-bank housing finance company under the Securities and Exchange Commission of Pakistan (SECP), AGFL has made remarkable progress in its commitment to fostering affordability and promoting home ownership.

With a strong dedication to ethical practices and a client-centric approach, AGFL continues to pave the way for sustainable and inclusive homeownership, transforming lives and communities across Pakistan.

SIMA’s Impact and Growth

Key Milestones

3

Funds Managed

140+

Companies Financed

89%

First-time Homeowners of All AGF Borrowers

USD 827M

Million Invested in Emerging Markets